Do you qualify for stimulus checks and child tax credits but missed the deadline of November 17? The good news is that you could still be able to get that money. You might not get the money right away, though.

When they submit their taxes the following year, eligible claimants can get their stimulus funds. On Tax Day in 2025, you can still collect any money owed to you, but it’s advised to file as soon as you can.

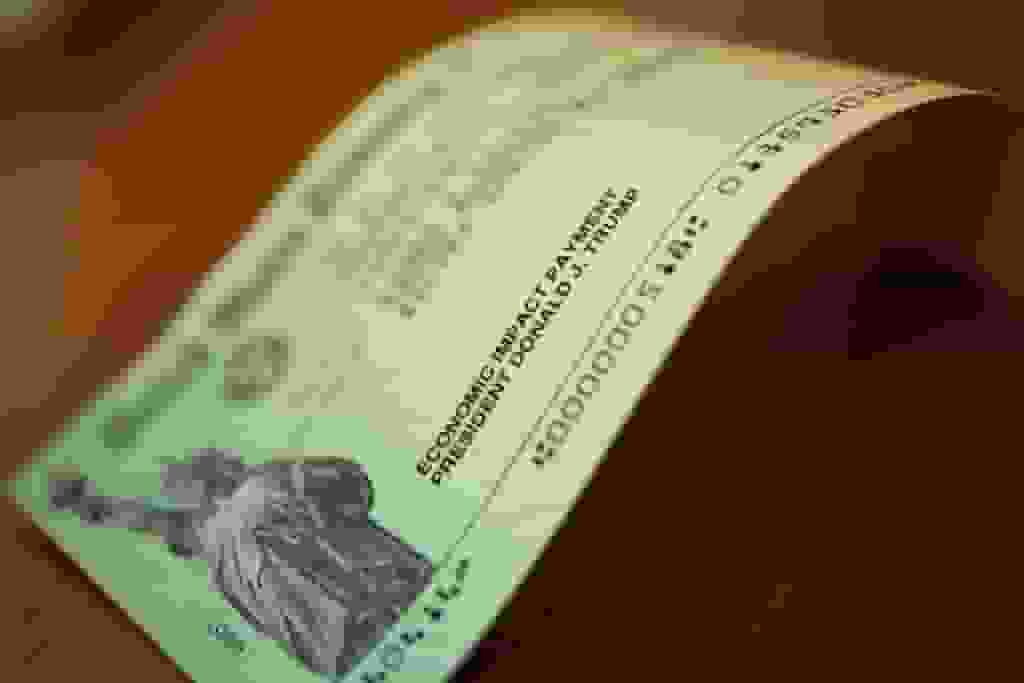

Unclaimed Stimulus Checks

Three rounds of stimulus checks were provided by the US government during the pandemic. The first one, for $1,200, came out in April 2020. The second, costing $600, came out in December of the same year.

For those who submitted a 2020 tax return and completed certain income requirements, the third stimulus check, totaling $1,400, was distributed in March 2021. Reportedly, this was accomplished by submitting taxes and collecting the Recovery Rebate credit.

Families could get up to $3,600 per child under the expanded child tax credit last year, or up to $1,800 if they got monthly payments. Parents of children under the age of six receive the largest child tax credit, at $3,600, while those of children between the ages of six and seventeen receive a child tax credit worth $3,000 per child.

If they did not receive advance payments of nearly half of those funds through monthly and child tax credit payments, a family must file a federal 2021 income tax return in order to receive the remaining funds.

Low- and middle-income workers are eligible for this earned income tax credit. Additionally, it was improved for that tax year. People without children could still be eligible for tax credits.

Unclaimed Tax Rebates

Do you qualify for stimulus payments and child tax credits but missed the deadline of November 17? The good news is that you could still be able to get that money.

Workers without children may be eligible for up to $1,502, and filers with three or more children may be eligible for up to $6,728. More employees are now eligible for tax credits for the 2021 tax year thanks to the expansion of eligibility.

According to a report, the IRS wrote to more than 9 million American families in October who haven’t submitted their federal tax forms. The organization kindly reminded these families that regardless of whether they have kids or not, they can still be eligible for these tax benefits.

Millions of South Carolinians, meantime, last month received a one-time income tax credit of up to $800. Up to the end of the year, printed checks, debit cards, and direct deposits will be made by the state’s Department of Revenue.

In Illinois, which continues to offer $50 and $100 income tax refunds, the same thing is taking place. In the meantime, Massachusetts has begun returning $3 billion in excess tax money to its citizens.