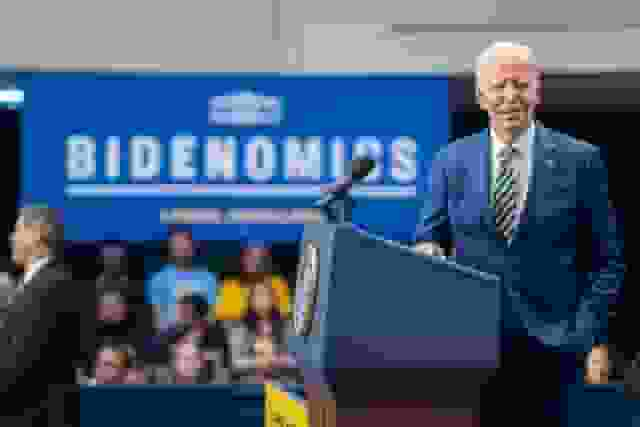

President Biden proposes significant changes to bolster Social Security, ensuring its sustainability and improving benefits for retirees and beneficiaries.

This move has garnered attention and sparked discussions about the potential positive impact it could have on the lives of many Americans.

Biden Aims to Reform Social Security for a Brighter Future

The proposed reform envisions changes to the taxation of high-income earners, which could inject much-needed funding into the Social Security Trust Fund. Currently, the Social Security tax is capped at a certain income threshold, beyond which no further contributions are required.

Biden’s proposal suggests imposing Social Security taxes on earnings over $400,000 annually, a move anticipated to bolster the sustainability of the program.

Additionally, the plan aims to provide a financial boost to Social Security beneficiaries. This includes ensuring that individuals who have received benefits for at least 20 years see a benefit increase, resulting in a more substantial income for retirees. Furthermore, surviving spouses and caregivers could potentially see a rise in benefits, addressing a critical aspect of the Social Security program.

Read more: US Inflation Brightens: Outlook Improves As Underlying Price Pressures Subside

Potential Economic Implications

Advocates of the proposal emphasize its potential to address income inequality by redistributing resources and offering a safety net for the most vulnerable.

By taxing high-income earners and increasing benefits for those who rely heavily on Social Security, the plan strives to promote financial security and equality in retirement.

However, critics argue that the tax changes could have implications for businesses and investments, potentially influencing job creation and economic growth.

Striking the right balance between funding Social Security adequately and not stifling economic progress will be a key consideration in the ongoing discussions regarding the reform.

As the proposed reforms undergo further scrutiny and debate, the American public remains eager to see how this potential change may impact the Social Security system and their financial well-being in retirement.

The outcome of these discussions could reshape the future of retirement benefits for millions of Americans.

Read more: IRS Contractor Faces Charges For Alleged Leak Of Wealthy Individuals’ Tax Return Information