Rates for 5- and 10-year variable-rate borrowers who use the Credible marketplace to refinance student loan refinancing decreased this week once more.

You can evaluate alternatives from several private lenders using an online tool like Credible if you’re interested in learning what kind of student loan refinance rates you might be eligible for.

Postponed Payments Discourage Student Loan Refinancing

Interest and payments on federal student loans have been postponed through this year, and possibly for as long as 30 days past June 30, 2023, in order to provide relief from the financial effects of the COVID-19 epidemic.

There is little incentive to refinance federal student loans as long as that benefit is in place.

However, a lot of people with private student loans are refinancing their debt for schooling at reduced rates by taking advantage of the low interest rate environment.

If you are approved for student loan refinancing, the interest rate you may be given will depend on a number of things, including your FICO score, the type of loan you want (fixed or variable rate), and the length of the loan payback period.

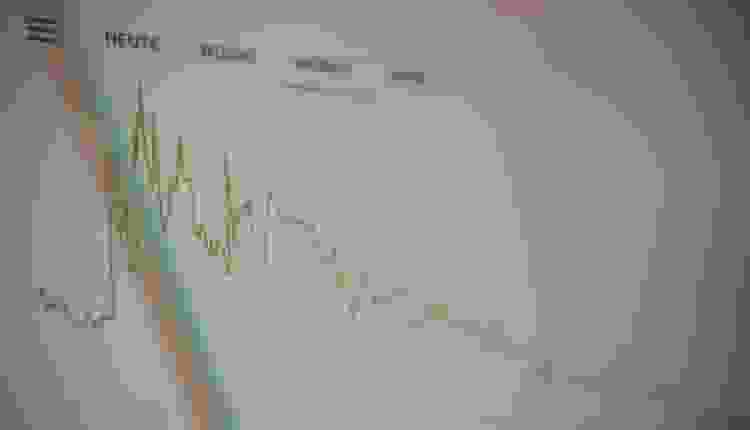

The graph above demonstrates that rates can be lowered with good credit and that they are typically higher for loans with set interest rates and longer repayment terms.

Read more: Student Loan Forgiveness: Key Dates To Remember Before Payment Resumes

Graduates Can Refinance Parent PLUS Loans Independently

It is a good idea to seek rates from several lenders so you can compare your options because each lender has a different system to evaluate borrowers.

Calculators for student debt refinancing might assist you in determining potential savings.

You might need to apply with a cosigner if you want to refinance but have terrible credit.

Alternative: before applying, work on raising your credit score. After graduating, many lenders permit youngsters to refinance parent PLUS loans in their own names.

Without damaging your credit score, you may compare rates from several private lenders at once using Credible.

Read more: Bright Outlook: The Promising Future For Student Loan Borrowers