A student loan borrower who had been struggling under the weight of her debt for more than 30 years finally received relief.

Zena Dodson’s $78,000 in student loans were discharged by the Western District of Washington at Seattle Bankruptcy Court as a result of new bankruptcy guidance that the Education and Justice Departments announced last year, according to Student Defense, a group that promotes borrower protections, and Latife Neu of Neu Law.

$78K in Student Loans

Dodson attended Seattle’s Griffin Business College, a for-profit institution, in 1988, and, according to court documents, she borrowed $18,955 in student loans to pay for her study.

Following complaints filed by a number of students who claimed they had been misled by the institution, the school was closed in 1993.

Dodson struggled financially after returning to repayment in the early 1990s, and as a result of late fines and rising interest, her most current balance was $78,715.

Dodson, who is now 59 years old, provides for her grandchild and two grown daughters.

According to the legal document, she has spent the majority of her 30-year career working in public service and makes every attempt to keep her costs to a minimum.

While receiving a student debt discharge in 2014, Dodson’s loans were not cancelled as a result of those proceedings due to federal legislation at the time.

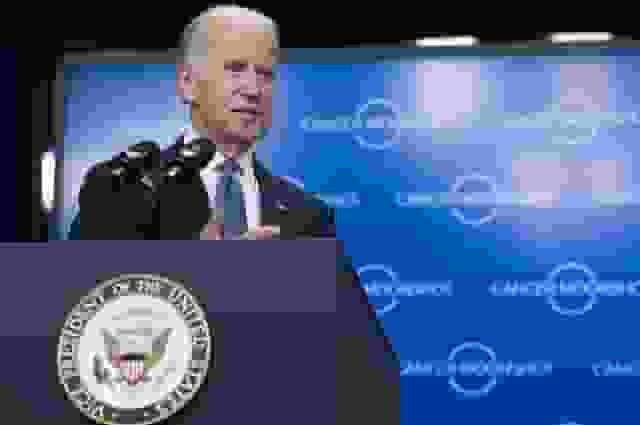

Dodson was able to secure relief because to Biden’s Education and Justice Department recommendations from a year ago, which streamlined the procedure for student-loan borrowers to do so.

Prior to the advice, borrowers were had to establish the undue hardship requirement, which requires them to demonstrate that they are unable to maintain a basic level of life, that their situation is unlikely to get better, and that they have made a good-faith effort to repay their debt.

The new guidance made it easier for borrowers to complete a self-attestation form to help the departments evaluate their discharge request, which has proven to be exceedingly challenging to fulfill in court.

While the undue hardship threshold is still in place, the advice offers clear principles to enable fair evaluation of all borrowers while saving the Justice Department time that would otherwise be required for laborious investigations.

Read more: IRS Appointments: Tips For Getting Through And Finding The Best Time To Call

Eligibility Requirements and Application Process for Studen Loan

Meanwhile, there are numerous relief programs available right now, and each one has a unique set of eligibility conditions.

Normally, a significant life event or having worked in a qualified occupation for the required number of years may qualify you for relief.

Although some programs might be accessible with private lenders, the majority of student loan relief options are only available for federal student loans.

If you believe you are eligible for relief, speak with your loan servicer to find out whether you do. Along the way, it’s a good idea to check in with your servicer to make sure you’re moving toward relief.

Get in touch with your school directly if you have a Perkins Loan. They might point you toward their loan servicer, though.

On the Federal Student Aid website, which has materials for each program, you can also submit an application for relief.

Read more: Maximizing Your Social Security Benefits: Tips For Qualifying For A Bonus