This month, a hot pricing report and a solid jobs report dashed hopes that the economy was recalibrating and inflation was permanently declining.

For many Americans, an increase in employment is a positive development, but a thriving economy is accompanied by an increase in inflation.

Reduced Inflation

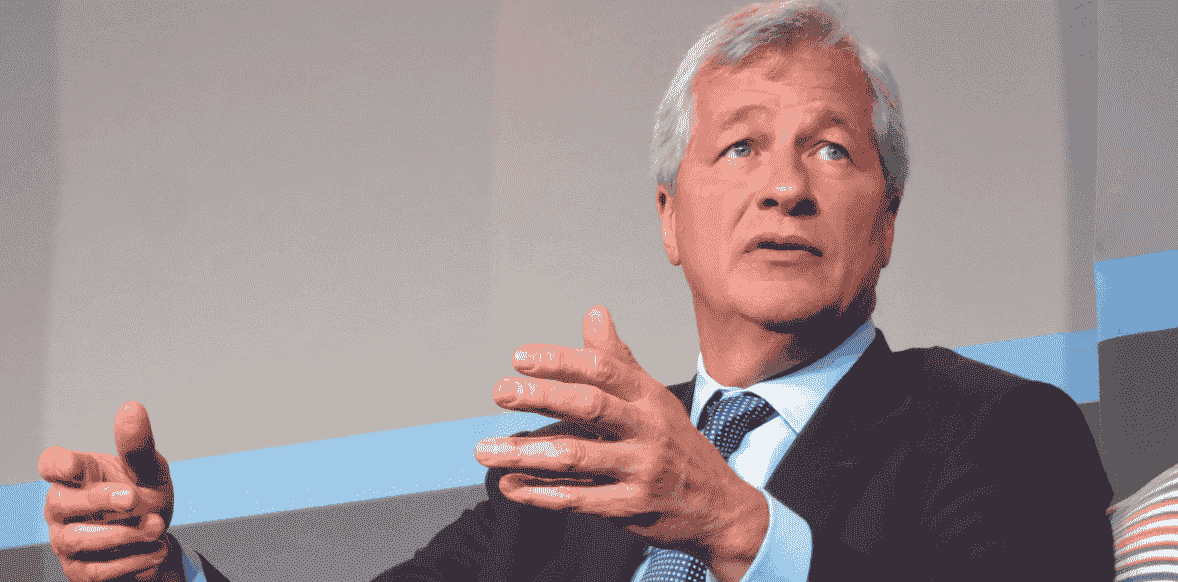

Jaime Dimon, chief executive officer of J.P. Morgan Chase, believes that the economy is thriving, but that the Federal Reserve will struggle to control inflation.

The US economy is healthy. Consumers enjoy affluence Dimon told Jim Cramer on Thursday that the labor market is strong. Today The future holds dreadful events. Both parties are willing to bear uncertainty.

The Fed raised interest rates eight times in the last year, bringing year-over-year consumer price rises from a 40-year high of 9.1% in the summer of 2017 to 6.4% in December.

Christopher Waller, a Fed governor, referred to the latest economic data as good news in a January speech, but Jerome Powell frequently referred to disinflation this month.

Dimon, echoing St. Louis Federal Reserve President James Bullard, who stated last week that the robust labor market demonstrated that the US economy is stronger than we thought, warned that interest rates might possibly remain higher for longer as the Fed fights to reduce inflation. Bullard stated that the hot economy could make deflation more difficult than anticipated.

Read more: Atlanta Hawks fires Nate McMillan; Who will take over Atlanta’s interim head coach?

Federal Spending Initiatives

The $1 trillion infrastructure initiative of 2021 and the $280 billion CHIPS Act are economic game-changers, and robust consumer spending in the United States is inflationary.

Dimon observed that the infrastructure plan features some positive aspects, but that excessive government spending will likely make it more difficult to control inflation, hence increasing the Fed’s duty and lengthening its tenure.

The previous year, Dimon cautioned that the U.S. economy had a one-in-three chance of averting a recession, that his bank was prepared for an economic storm, and that investors should anticipate protracted market turbulence.

In January, he anticipated a soft landing or modest economic slowdown rather than a severe recession, although he cautioned that a severe recession remained a one-in-three chance. Dimon indicated persistent anxiety about the U.S. economy.

Before proclaiming victory on this subject, people should take a big breath, he added, adding that the Fed may need to hike interest rates once more to reduce inflation.

Joining other bankers and economists, such as Mohamed El-Erian, who have cautioned that meeting this aim could precipitate a severe recession, Ben Bernanke stated on Thursday that it could take some time for the Fed to reach its inflation target of 2%.

Read more: Social Security Expansion: Those who will turn 62 may be eligible for an additional $2,400!