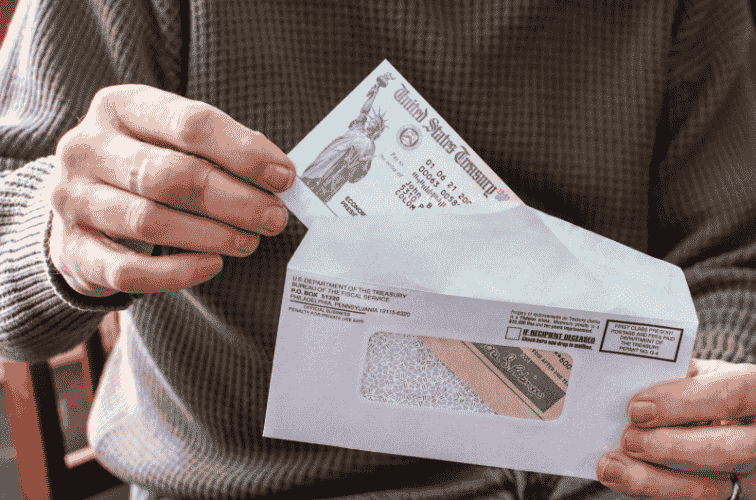

The remaining Americans can receive a $3,000 stimulus check once they meet the eligibility requirements. Here’s what you need to know!

You must be aware that applicants are needed to submit a form in order to receive these stimulus checks. The deadline for submitting it annually is March 31, so you must do so by that day. The Treasury Department does not plan to apply for the benefit from last year at this time.

Stimulus Check Amount

The payout schedule for those expecting their PFD for 2022 was nevertheless released. It is essential to note that this only applies to candidates whose applications are in the Eligible-Unpaid status.

Those who qualify as Eligible-Unpaid as of February 8 will get their PFD payment on February 16. Conversely, those who fall into the March 8 category will receive it on March 16.

When the applications are accepted will determine when payment is issued. If the application is accepted before the fall payments, for example, you will be able to get the money when the checks and direct deposits are paid. In addition, if your application is accepted after the mass distribution, the monthly payment will be deducted once your eligibility has been determined.

It has been estimated to be around $3,000, although it may be greater. In truth, the anticipated amount may be precisely $3284. The region’s Permanent Dividend Fund sent funds to the state of Alaska (PFD).

The residents are rewarded and granted various benefits in the same manner each year. We are talking about the privileges granted to these citizens by the state in exchange for oil revenues. As a result, Alaska will get greater cash after 2022, when stimulus checks of up to $3,284 are distributed.

Read more: Child Tax Credit 2023: Changes that could affect your family tax returns

Why You May Receive Lower Tax Return?

The IRS issued a press release on January 23, 2023, signaling the start of tax season. This tax filing season, from January to April 2023, is for 2022 tax returns. You will report your earnings from the previous year, and you may be eligible for a tax refund.

In its news release, the IRS offered an important warning regarding the impact of stimulus payments on the federal return you will file this year. Because there were no government stimulus funds last year, the IRS clearly said that you may not receive your entire tax refund.

Because many individuals rely on their tax refunds to assist with debt repayment, account growth, or the attainment of other key financial goals, it is essential to read and comprehend this IRS warning, so you are not caught off guard.

According to an IRS news release, there are two primary reasons why your tax refund may be smaller than it was the previous year. In light of recent tax law changes, including the loss of the Advance Child Tax Credit and the removal of the Recovery Rebate Credit for the collecting of stimulus money connected to the epidemic, many taxpayers may find that their refunds are much lower this year.

The $1,400 checks authorized by the American Recovery and Reinvestment Act were referred to as the Recovery Rebate Credit. The Child Tax Credit was also increased by the American Recovery and Reinvestment Act, with parents receiving $3,600 for children under the age of six and $3,000 for children between the ages of six and seventeen. These amounts are assigned to every child.

Read more: Tax Return: How to find out if IRS still owes you money?