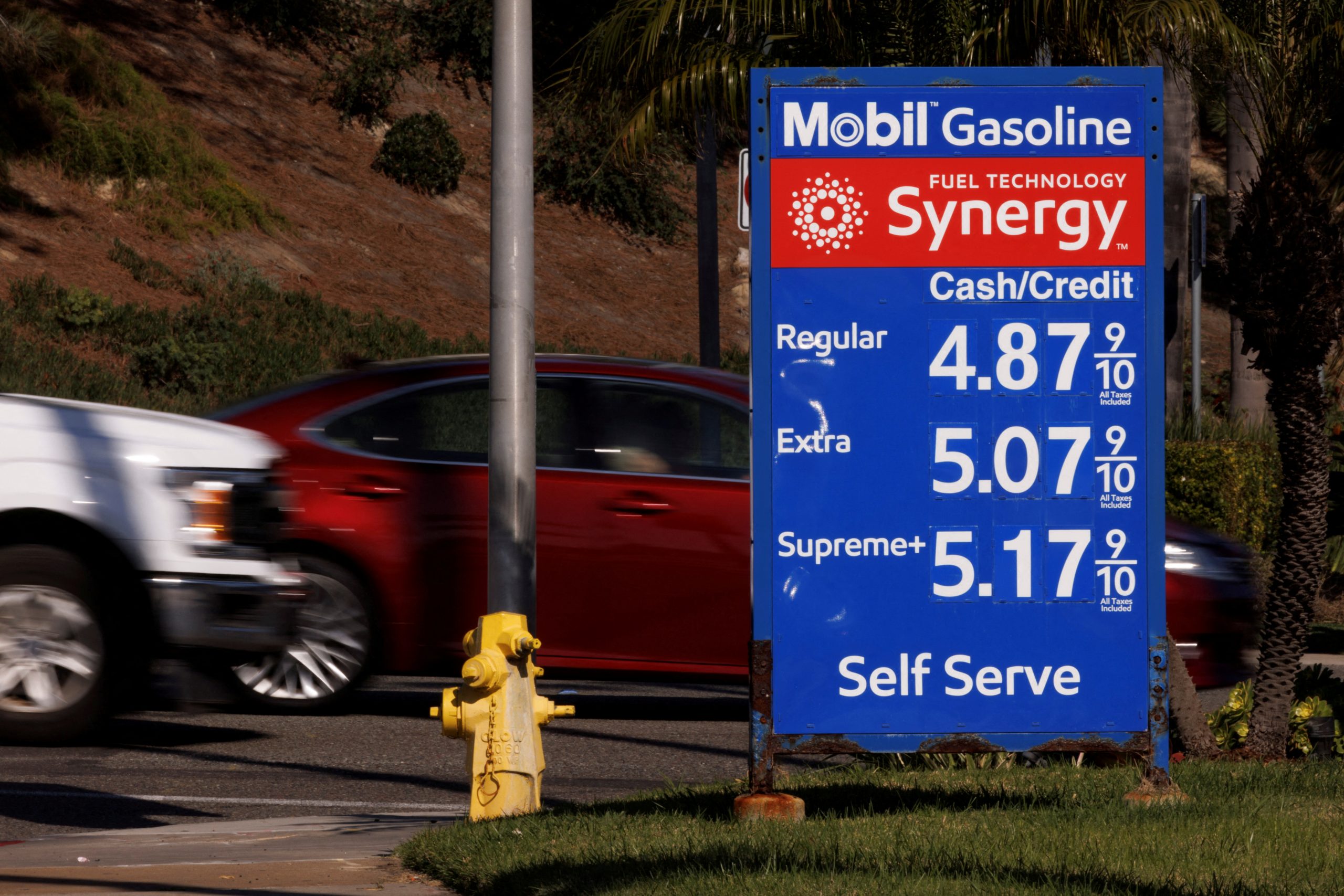

From the White House, where his economic advisors were standing on each side of him, US President Joe Biden declared, “Make no mistake: prices are still too high. We still have a ton of work to do.”

“However, things are improving and moving in the right direction. Nevertheless, other economists contend that further months of data are required in order to determine if inflation has peaked,” he continued. This week, the Federal Reserve is also anticipated to increase interest rates once more.

Joe Biden: US Economy Is ‘Improving’

Following a series of aggressive interest rate hikes by the Federal Reserve intended to cool an overheating economy, shares soared higher in early trade as new data revealed that inflation fell more than predicted last month.

The good news came ahead of the Fed’s final meeting of the year when it is anticipated to announce a 50 basis point increase in interest rates after four straight increases of 0.75% this year that alarmed analysts, businesses, and consumers about a potential recession.

The lack of economic clarity has caused advertisers to pull back, according to a number of media executives in recent weeks, who have seen a gloomy ad market.

Tomorrow afternoon, Fed Chair Jerome Powell will hold a press conference. Off premarket highs, the DJIA started the day up 600 points. Disney is up 1.57 percent, Warner Bros. Discovery is up 4.5%, and Comcast is up 3% among major media stocks.

US Inflation

According to monthly data issued today by the Bureau of Labor Statistics, the Consumer Price Index, or CPI, increased 7.1% from the previous year and 0.1% from October.

Expectations were anticipating a greater 7.3% annual growth, which would have been consistent with the 0.1% monthly growth. When volatile costs for food and energy are removed, what is referred to as “core” inflation increased by 6% annually and 0.2% monthly in November, falling short of estimates of a 6.1% and 0.3% increase.

With a 7.1% annual increase, housing prices accounted for over half of the increase in the core CPI.

In an effort to battle inflation that was also at a 40-year high, the Fed increased rates at a rate that had not been seen since 1980. Prices have increased this year due to a number of factors, such as increased demand and consumer spending, ongoing supply-chain problems with Covid, and other interruptions brought on by the Russia-Ukraine war.

Read more: Application for SSI payments and food stamps may become easier!