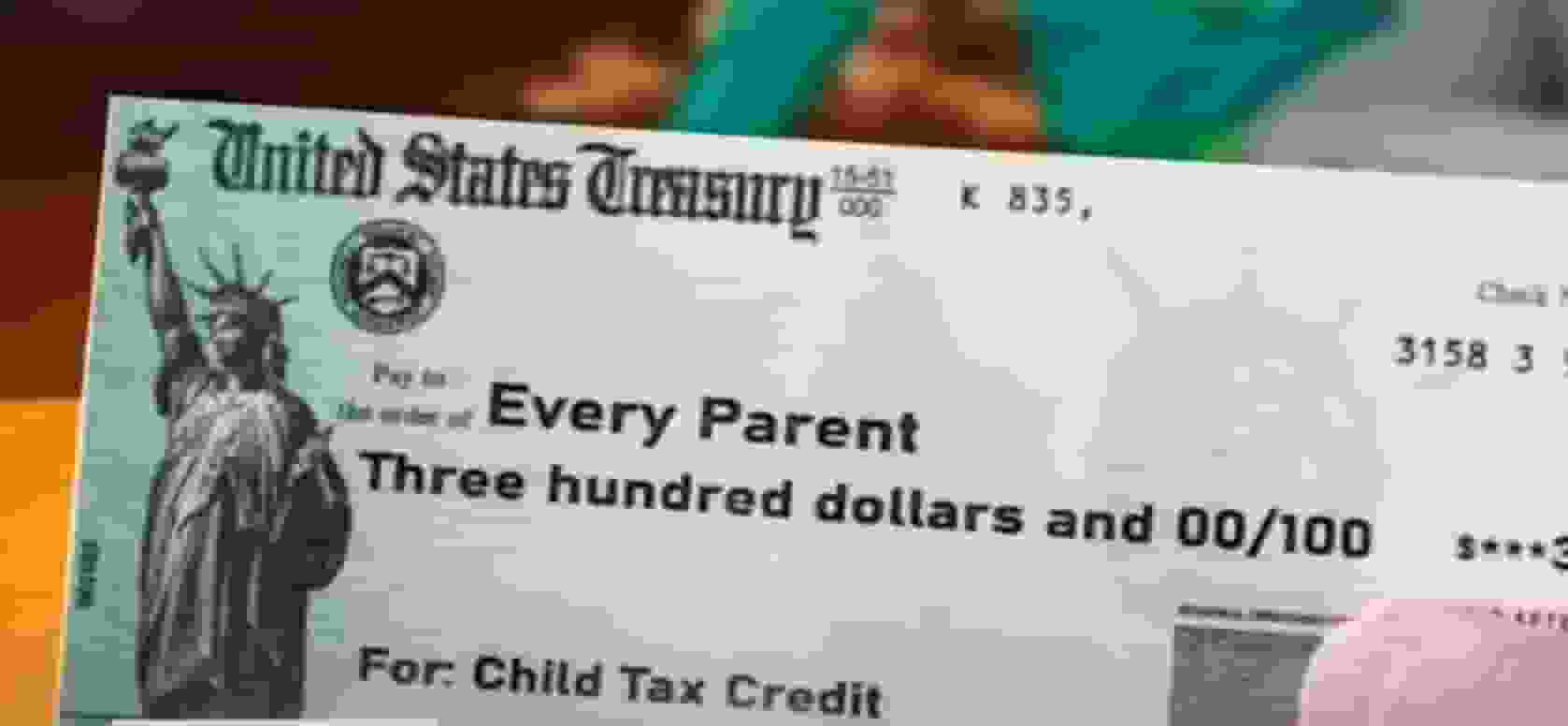

Nothing meets the criteria for a fourth stimulus check. And the payment for the sixth and final child tax credit installment of 2021 is due in less than a month. Here is how some of you will still receive a $1,400 stimulus check in 2022 after all of that.

The deciding factor is expecting a child this year. According to several sources, parents who have a newborn in 2021 will qualify for a further $1,400 stimulus payment in 2022.

Final Stimulus Check

According to past publications, they would receive that reward when they submit their federal taxes in 2022. Technically, this shouldn’t be regarded as a fourth stimulus check in the same way as the previous three. This is because many Americans received three installments totaling $1,200, $600, and $1,400.

Of course, a far lower percentage of people must become parents for various reasons. Like the other three, this payment does not give the federal government the vast, all-encompassing economic boost it had hoped for.

That an income barrier is present in this situation also shouldn’t come as a surprise. For single filers, the maximum yearly adjusted gross income that qualifies them for this payment is $75,000.

Couples must earn less than $150,000 to get the whole amount. The $1,400 eventually diminishes for wages beyond specific limits. Additionally, it reduces for filers who are single and make above $80,000 or for married couples who make over $160,000.

Around 9 million taxpayers who would have been eligible for the stimulus payment or the child tax credit neglected to file their taxes in the previous tax year. These people are primarily low-income people who are excused from filing taxes.

Because the IRS used tax returns to determine who qualified for stimulus funding, these people were ignored. The IRS did give these people some extra time to submit their taxes. To make it easier for people to file their taxes, the group also created the IRS free file form.

Read more: Mexico, US collaborate on a strategy to attract businesses from Asia to North America.

Unclaimed Stimulus Payment

The quickest and easiest way to receive a refund according to the IRS is to file a return electronically and opt for direct deposit. Filers have several alternatives, including well-known tax software, online services, or tax professionals.

It should be underlined that only those with adjusted gross incomes of less than $75,000 were eligible for the most recent round of stimulus funds. Only a fraction of the $1,400 was available to people making more than $80,000, and no payments were made to those earning more than that amount.

Those with earnings in that range received reduced compensation. The ceiling for joint filers was $150 000, with a maximum of $160 000.

The IRS also notes that those who failed to file their taxes may have been disqualified from the expanded Child Tax Credit, worth up to $3,600 per child, or the Earned Income Tax Credit, worth up to $1,502 for workers without qualifying children, $3,618 for those with one child, $5,980 for those with two children, and $6,728 for those with at least three children.

At childtaxcredit.gov/file, taxpayers who made less than $12,500 (or $25,000 for couples) can submit a streamlined tax return for the Child Tax Credit.

Read more: Chinese hackers stole millions of US COVID-relief money, Secret Service claims